Global Cold Form Blister Packaging Market Size, Share, Growth Analysis Report - Forecast 2034

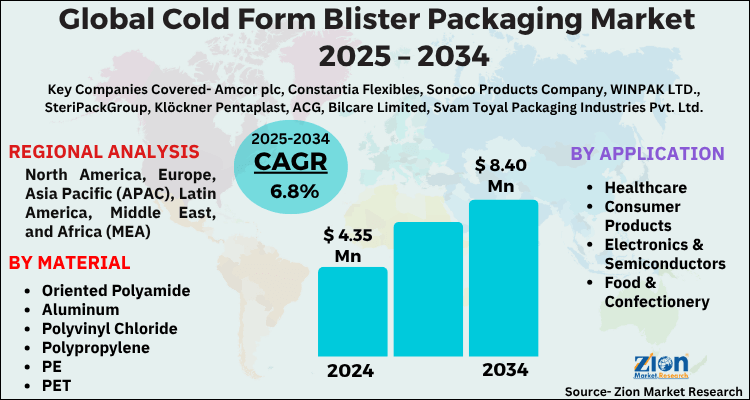

Cold Form Blister Packaging Market By Material (Oriented polyamide, Aluminum, Polyvinyl Chloride (PVC), Polypropylene (PP), Polyethylene (PE), Polyethylene Terephthalate (PET)), By Application (Healthcare, Consumer Products, Electronics & Semiconductors, Food & Confectionery, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.35 Billion | USD 8.40 Billion | 6.8% | 2024 |

Global Cold Form Blister Packaging Market: Industry Perspective

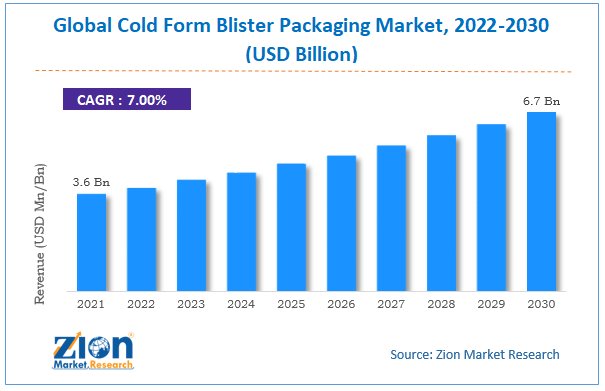

The global cold form blister packaging market size was worth around USD 4.35 Billion in 2024 and is predicted to grow to around USD 8.40 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 6.8% between 2025 and 2034. The report analyzes the global cold form blister packaging market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the cold form blister packaging industry.

The report analyzes the global cold form blister packaging market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the cold form blister packaging market.

Global Cold Form Blister Packaging Market: Overview

Aluminum-containing laminate film in the shape of thin sheets is used in the cold forming blister packing technique. Cold forming employs a stamp to push the sheets into a form, which enables the aluminum-based film to stretch and hold the mold shape after the stamp is withdrawn to produce blister packs. Pharmaceuticals are frequently packaged using the cold form blister packaging method because the aluminum-based film prevents moisture from entering the packing.

Global Cold Form Blister Packaging Market: Growth Drivers

Growing demand for cold blister packaging in various industries along with its cost-effectiveness to drive the market

When compared to alternative packaging types, such as rigid bottles, cold blister packaging uses fewer resources for packaging, takes up less space on retail shelves, and provides a great hang-hook display, which results in lower costs. The need for cold blister packaging in the pharmaceutical business has increased as a result of the growing demand for practical and tamper-proof packaging. The global cold blister packaging market is expanding as a result of rising demand from end-use sectors such as food, industrial goods, healthcare, and consumer goods.

Restraints:

The packaging of heavy products is not best accomplished in cold blister packaging

Blister packaging is generally used to protect lightweight things and is not the best option for the packing of heavier items. Heavy items will put more pressure on the plastic film or paperboard that supports them during packing. This could lead to package damage while handling, storing, and shipping the product, which would increase costs and result in product loss. In addition, it is not recommended to utilize blister packing for expensive and fragile products because it could cause the product to crack or be damaged, costing the producer money. The market for cold blister packaging may see growth difficulties as a result of this scenario.

Opportunities:

Increasing demand from food industries is expected to provide an opportunity for the market expansion

Cold blister packing is most frequently used in the food business. Retailers can package a wide range of fresh foods, including fruit, meat, bakery goods, candies, ice cream, etc., in highly practical blister packs. Food is protected from harm during handling and transportation by blisters in addition to displaying the goods well.

Blisters also have good product protection qualities and are lighter than materials like glass or metal. Even for packing relatively modest products, blisters are inexpensive and make it simple to adhere to tight hygiene requirements. Blisters are frequently used as the interior of luxury boxes for packaging chocolate. Therefore, the increasing demand for cold form blister packaging from food industries provides a lucrative opportunity for global cold form blister packaging market expansion.

Challenges:

Strict regulation for blister packaging act as a major challenge for the market growth

The blister packaging market may face difficulties if strict regulations are implemented, particularly in the healthcare sector. Compliance with standards is required since even a little packaging flaw could cause harm to the product and negatively affect the manufacturer's bottom line. The Food and Drug Administration (FDA) mandates that each blister cell's label include the manufacturer's name, the trademarked and established name, the strength, the expiration date, and a bar code. Meeting the requirements of such regulations requires work, expense, time, and resources, which is difficult and could impede the market's expansion for cold blister packing.

Key Insights

- As per the analysis shared by our research analyst, the global cold form blister packaging market is estimated to grow annually at a CAGR of around 6.8% over the forecast period (2025-2034).

- Regarding revenue, the global cold form blister packaging market size was valued at around USD 4.35 Billion in 2024 and is projected to reach USD 8.40 Billion by 2034.

- The cold form blister packaging market is projected to grow at a significant rate due to increasing demand from the pharmaceutical and healthcare industries for secure, tamper-evident, and high-barrier packaging solutions, coupled with a rising focus on product integrity and extended shelf life.

- Based on Material, the Oriented polyamide segment is expected to lead the global market.

- On the basis of Application, the Healthcare segment is growing at a high rate and will continue to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Global Cold Form Blister Packaging Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Cold Form Blister Packaging Market |

| Market Size in 2024 | USD 4.35 Billion |

| Market Forecast in 2034 | USD 8.40 Billion |

| Growth Rate | CAGR of 6.8% |

| Number of Pages | 242 |

| Key Companies Covered | Amcor plc, Constantia Flexibles, Sonoco Products Company, WINPAK LTD., SteriPackGroup, Klöckner Pentaplast, ACG, Bilcare Limited, Svam Toyal Packaging Industries Pvt. Ltd., Tekni-Plex, Inc, Essentra plc, Ningbo Dragon Packaging Technology Co., Ltd., Rollprint Packaging Products, Inc., R-Pharm Germany GmbH, Wasdell Group, Shanghai Haishun New Pharmaceutical Packaging Ltd., and others. |

| Segments Covered | By Material, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Cold Form Blister Packaging Market: Segmentation

The global cold form blister packaging market is segmented based on material, application, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2025 to 2034.

Based on material, the global market is bifurcated into oriented polyamide, aluminum, polyvinyl chloride, polypropylene, PE, and PET. The aluminum segment held the largest market share in 2021 at over 40% and is expected to dominate the market during the forecast period. Dry bond lamination is used to sandwich the aluminum foil between the PVC and Nylon layers. Utilizing aluminum foil protects food from moisture, oxygen, and light, extending the shelf life of the item until its expiration date.

The healthcare industry contributes the largest portion of aluminum material's revenue share. The growing demand for medications to treat illnesses brought on by such behaviors is being supported by the rising prevalence of chronic diseases as a result of the changing lifestyles of the population, stressful work-life schedules, sedentary lives, and bad eating habits. Six out of ten Americans, according to the National Center for Chronic Disease Prevention and Health Promotion (NCCDPHP), have at least one chronic illness, such as diabetes, cancer, or heart disease. The nation's annual healthcare costs are USD 3.8 trillion as a result of this. Thus, driving the segmental growth over the forecast period.

Based on the application, the global cold form blister packaging is categorized into healthcare, consumer products, electronics & semiconductors, food & confectionery, and others. The healthcare segment accounted for the largest revenue share in 2021 and is expected to show its dominance during the forecast period. Drug packaging for oral administration, such as tablets, capsules, and inhaler medicine, is included in the healthcare segment. Aluminum is the most often utilized material for cold form blister packing in the healthcare industry.

Since aluminum foil has such a diverse range of mechanical qualities, it is frequently utilized in cold-form blister packaging. Cold form foils have an easy-to-use "push-through" feature and are made of a preformed plastic tray with an aluminum foil closure. The aqueous medications are placed in cold-formed trays, which are then freeze-dried into individual tablets with compartmentalized shapes resembling airfoils. Thus, influencing the segmental growth during the forecast period.

The Regional, this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa.

Recent Developments:

- In April 2024, Bostik, a leading international expert in adhesives for the commercial, industrial, and consumer markets, introduced HERBERTSTM EPS 8760/KN75, a high-performance, intelligent adhesive that has been created to enhance the process automation of cold forming blister packaging for the pharmaceutical industry. To preserve the potency of the active substances, pharmaceutical items must adhere to strict cleanliness and safety requirements because any deviations from these norms could have detrimental effects on the customer. Local drug safety regulations are met by HERBERTSTM EPS 8760/KN75. For nylon, aluminum, and PVC (NY/AL/PVC), HERBERTSTM EPS 8760/KN75 offers a consistent bonding strength and superior deep drawing ability to deliver good long-term delamination resistance and retention of packaging structure even after prolonged durations. This leads to effective quality and process handling control, as well as maximized production speed and reliability. HERBERTS™ EPS 8760/KN75 can be utilized on unit-dose packaging for pharmaceutical tablets, capsules, or lozenges, presenting excellent clarity and clean optical appearance compared to existing market solutions.

- In April 2024, a contract packaging service has been introduced by Sepha, a company that specializes in pharmaceutical packaging and equipment, to fulfill the growing need for small batch production. Sepha's new contract packaging service is geared toward the pharmaceutical, nutraceutical, and medical device industries and focuses on offering blister and medical device packs in quick turnarounds in limited volume runs at reasonable prices. Customers can take advantage of prompt and adaptable manufacture of packs for testing, research, and sampling, regardless of the availability of bigger blister pack lines.

Global Cold Form Blister Packaging Market: Regional Analysis

The cold form blister packaging market exhibits varied growth trends across regions, with Asia-Pacific emerging as the fastest-growing market due to rapid expansion of the pharmaceutical sector, increasing healthcare expenditures, and rising demand for high-barrier packaging solutions to protect sensitive drugs. North America holds a significant market share driven by stringent regulatory standards for pharmaceutical packaging, technological advancements, and strong presence of key pharmaceutical manufacturers. Europe also contributes substantially, supported by a well-established pharmaceutical industry and growing emphasis on patient safety and product integrity. Meanwhile, regions like Latin America and the Middle East & Africa are witnessing gradual growth, fueled by improving healthcare infrastructure and increasing awareness about secure drug packaging, though challenges such as economic constraints and lower manufacturing capacities temper the pace of expansion in these areas.

GlobalCold Form Blister Packaging Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the cold form blister packaging market on a global and regional basis.

The global cold form blister packaging market is dominated by players like:

- Amcor plc

- Constantia Flexibles

- Sonoco Products Company

- WINPAK LTD.

- SteriPackGroup

- Klöckner Pentaplast

- ACG

- Bilcare Limited

- Svam Toyal Packaging Industries Pvt. Ltd.

- Tekni-Plex Inc.

- Essentra plc

- Ningbo Dragon Packaging Technology Co. Ltd.

- Rollprint Packaging Products Inc.

- R-Pharm Germany GmbH

- Wasdell Group

- Shanghai Haishun New Pharmaceutical Packaging Ltd.

Global Cold Form Blister Packaging Market: Segmentation Analysis

The global cold form blister packaging market is segmented as follows;

By Material

- Oriented Polyamide

- Aluminum

- Polyvinyl Chloride

- Polypropylene

- PE

- PET

By Application

- Healthcare

- Consumer Products

- Electronics & Semiconductors

- Food & Confectionery

- Others

Global Cold Form Blister Packaging Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Aluminum-containing laminate film in the shape of thin sheets is used in the cold forming blister packing technique. Cold forming employs a stamp to push the sheets into a form, which enables the aluminum-based film to stretch and hold the mold shape after the stamp is withdrawn to produce blister packs. Pharmaceuticals are frequently packaged using the cold form blister packaging method because the aluminum-based film prevents moisture from entering the packing.

The global cold form blister packaging market is expected to grow due to rising consumer preference for convenient and protective packaging solutions, increasing demand for secure, tamper-evident packaging in pharmaceuticals and healthcare, stringent regulatory requirements, and the growing emphasis on sustainability and extended product shelf life.

According to a study, the global cold form blister packaging market size was worth around USD 4.35 Billion in 2024 and is expected to reach USD 8.40 Billion by 2034.

The global cold form blister packaging market is expected to grow at a CAGR of 6.8% during the forecast period.

North America is expected to dominate the cold form blister packaging market over the forecast period.

Leading players in the global cold form blister packaging market include Amcor plc, Constantia Flexibles, Sonoco Products Company, WINPAK LTD., SteriPackGroup, Klöckner Pentaplast, ACG, Bilcare Limited, Svam Toyal Packaging Industries Pvt. Ltd., Tekni-Plex, Inc, Essentra plc, Ningbo Dragon Packaging Technology Co., Ltd., Rollprint Packaging Products, Inc., R-Pharm Germany GmbH, Wasdell Group, Shanghai Haishun New Pharmaceutical Packaging Ltd., among others.

The report explores crucial aspects of the cold form blister packaging market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed